The world of day trading is risky, demanding both skill and a dash of courage. To truly prosper in this fast-paced arena, you need more than just fate. A seasoned day trader understands the secrets of the market and leverages them to their advantage. This guide will equip you with the knowledge and strategies necessary to become a dominant force in the trading world. more info

- Unveiling the Psychology of Successful Day Traders

- Chart Analysis: Reading the Market's Language

- Capital Preservation: Protecting Your Profits

- Approaches: Mastering the Art of Execution

- Tech Arsenal: Empowering Your Trading Edge

Day trading is not for the faint of heart. It requires dedication, continuous improvement, and a willingness to adapt with the market's ever-shifting landscape. But with the right tools, knowledge, and mindset, you can turn day trading into a rewarding and profitable venture.

Unlocking Profits: Mastering the Art of Day Trading

Day trading demands a unique set of skills and strategies. It's not just about acquiring and selling securities within a single timeframe; it's about interpreting market shifts and implementing trades with precision.

Successful day traders exhibit a sharp understanding of technical analysis, fundamental analysis, and risk management. They regularly observe market indicators and adapt their strategies accordingly.

This intense journey requires focus, a stoic temperament, and the skill to handle both gains and drawbacks.

Profitable Day Trading Techniques

Navigating that volatile world of day trading requires a keen eye and a disciplined approach. Achieving consistent gains isn't chance, it's the consequence of employing proven strategies and adhering to a strict trading system. One popular day trading strategies include:

- Momentum Trading: Capitalizing short-term price fluctuations, scalpers aim for quick profits by making multiple trades across a single session.

- Mean Reversion: These strategies exploit the natural tendency of prices to fluctuate around an average. Mean reversion traders look for price pullbacks, while trend followers ride the wave.

- Breakout Trading: Identifying significant price movements, these strategies utilize breakouts from established support and resistance levels. Gap traders profit from sudden price gaps that appear at the opening of a trading day or session.

Remember, successful day trading requires consistent practice, discipline, and risk management. It's crucial to develop your own strategy, backtest it rigorously, and always trade with stop losses. Never invest more than you can afford to lose.

From Novice to Ninja

Ready to jump in into the thrilling world of day trading? This ain't your grandma's trading playground. We're talking about high-octane action, split-second choices, and the potential to make serious gains.

- Begin your journey by mastering the fundamentals of day trading.

- Study the markets, understand technical indicators, and develop your trading plan.

- Practice your skills in a risk-free environment before diving in with real money.

It's a marathon, not a sprint.

Leveraging Frequency for Day Traders

Day trading demands an edge in today's fast-paced market. One strategy gaining traction is high-frequency trading (HFT), which involves executing numerous orders at lightning speed. To capitalize on this method, traders must implement advanced software. These include sophisticated algorithms capable of analyzing market signals and identifying profitable opportunities in real-time.

Successful HFT requires a deep understanding of market mechanics, technical analysis, and risk management.

Traders must be able to anticipate price movements and execute trades within milliseconds.

To gain an edge, day traders exploring HFT should:

* **Master Algorithmic Trading:** Develop or acquire scripts that can autonomously analyze market data and generate trade signals.

* **Optimize Execution Speed:** Utilize high-performance servers and low-latency connections to ensure rapid order execution.

* **Employ Risk Management Strategies:** Implement robust stop-loss orders and position sizing techniques to mitigate potential losses.

The path to success in HFT is demanding, requiring constant learning and adaptation. Traders must be willing to invest time and resources into mastering the details of this highly competitive domain.

The Ultimate Day Trader's Guide: Your Path to Riches

Day trading can seem challenging, but with the right blueprint, it can be a viable path to abundant freedom. A well-structured day trading plan is your map through the volatile world of markets, helping you navigate opportunities and ultimately achieve your trading goals. This blueprint will outline the essential steps to becoming a successful day trader, equipping you with the knowledge and tools to succeed.

- Harness technical analysis to identify profitable trading opportunities

- Craft a risk management strategy to protect your capital

- Comprehend various order types and exchange mechanics

- Regularly educate yourself on market trends and develop your trading expertise

Day trading is not a get-rich-quick scheme, it requires commitment, persistence, and a willingness to adapt. However, with the right mindset and a solid blueprint, you can transform day trading from a goal into a reality.

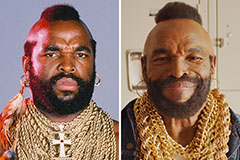

Mr. T Then & Now!

Mr. T Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Shane West Then & Now!

Shane West Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now!